Ten Year-End Tax Tips

As the year winds down, it is the perfect time to implement strategic financial moves that could significantly reduce your tax bill. Whether you are an individual taxpayer or a small business owner, taking steps now can lead to major savings in April. Here are ten recommended, actionable tax tips to help you maximize deductions, minimize liabilities, and ease the burden of tax season.

- Maximizing contributions to retirement accounts like a 401(k), IRA, or, for the self-employed, a SEP (Simplified Employee Pension) IRA or Solo 401(k), is an effective way to lower taxable income and build financial security for the future. For instance, if you are in the 24% tax bracket, contributing $10,000 to a retirement plan could yield $2,400 in tax savings. For specific 2024 contribution limits and details on tax benefits, visit IRS.gov.

- Consider tax-loss harvesting as a strategy to offset capital gains with capital losses, which can help reduce your taxable income if your portfolio performed well this year. This involves selling investments at a loss to counterbalance gains. For example, if you sold stock A for a $5,000 gain, you could sell stock B for a $5,000 loss to offset the gain, potentially saving you hundreds in taxes. For detailed guidance on implementing this strategy, consider consulting local financial advisors or exploring resources offered by investment firms.

- Optimizing charitable contributions by making donations to qualified charities before year-end can help you benefit from a tax deduction while supporting meaningful causes. Both cash and non-cash contributions are eligible, and these deductions can add up. For example, a $500 cash donation to a qualified charity could provide $120 in tax savings if you are in the 24% tax bracket. To find qualified charities, consider reaching out to local nonprofit organizations or community foundations, and refer to IRS guidelines for specific rules on charitable deductions. (Click here to view the “2024 Giving Guide” for more information on eligible local nonprofits.)

- If you are saving for education, consider making contributions to a 529 Plan before year-end, as it could provide state tax benefits in eligible states. These accounts grow tax-free as long as the funds are used for qualified education expenses. For example, a $5,000 contribution might offer a state income tax deduction where applicable. To learn more, you can explore a state-by-state guide to 529 tax benefits on savingforcollege.com or contact a local financial advisor for personalized guidance.

- Claiming energy tax credits can be a great way to save if you have made energy-efficient home improvements this year. Upgrades like installing solar panels, energy-efficient windows, or new insulation may qualify for federal tax credits. For instance, installing solar panels in 2024 could result in a 30% federal tax credit on the installation cost, potentially saving thousands. To explore local incentives or rebates, check with your state or local energy provider, and for details on federal credits, visit energy.gov.

- Self-employed individuals and small business owners can reduce their taxable income by prepaying necessary business expenses before year-end, such as office supplies, advertising costs, or software subscriptions. For example, prepaying $3,000 in expenses could result in $720 in tax savings if you are in the 24% tax bracket. To find additional guidance or local resources for small businesses, consider consulting a tax advisor or small business development center, and refer to IRS Publication 535 for details on deductible expenses.

- Maximizing contributions to a Health Savings Account (HSA) can provide triple tax benefits—contributions are tax-deductible, account growth is tax-free, and withdrawals for qualified expenses are also tax-free. For example, if you contribute $3,850 as an individual, you could reduce your taxable income by that amount, potentially saving you hundreds in taxes. For local guidance on HSAs, reach out to a financial advisor or local bank offering HSA accounts, and consult IRS Publication 969 for current contribution limits and details on qualified expenses.

- If you have had substantial medical expenses this year, you may be eligible to deduct out-of-pocket costs that exceed a specific percentage of your adjusted gross income (AGI). For instance, if you incurred $10,000 in medical expenses and have an AGI of $50,000, you could deduct expenses above $3,750, resulting in a $6,250 deduction. For a more personalized assessment, consider consulting a local tax advisor who is familiar with medical expense deductions, and refer to IRS guidelines, including Publication 502, for detailed information on eligible expenses.

- If you expect to be in a lower tax bracket next year, consider deferring year-end income—such as a bonus or a client payment—until January. For example, postponing a $5,000 bonus from December to January could help you stay in a lower tax bracket, potentially saving you hundreds in taxes. For personalized advice on how income deferral may impact your tax situation, reach out to a local tax professional.

- Partnering with a local tax professional can provide significant advantages, especially when dealing with intricate tax laws or managing small business finances and complex investments. A local tax expert can offer personalized insights, identify unique tax-saving opportunities, and guide you through year-end planning to maximize your savings.

It is essential to stay informed about recent tax law changes, as updates for 2024 may impact your financial strategies. For instance, retirement contribution limits for 401(k) and IRA accounts have been adjusted, so make sure you’re aware of the new caps. Additionally, energy tax credits have been expanded to cover more categories of home improvements, providing greater incentives for energy-efficient upgrades. For specific guidance on how these changes may affect you, consider reaching out to a local tax advisor, and visit IRS.gov for the latest updates and resources.

Taking these year-end tax actions can help maximize your savings, reduce your taxable income, and make tax season far less stressful. From retirement contributions to charitable donations, there are ample opportunities to keep more of your hard-earned money. Consult with a tax professional to tailor these strategies to your situation and start the new year with financial confidence.

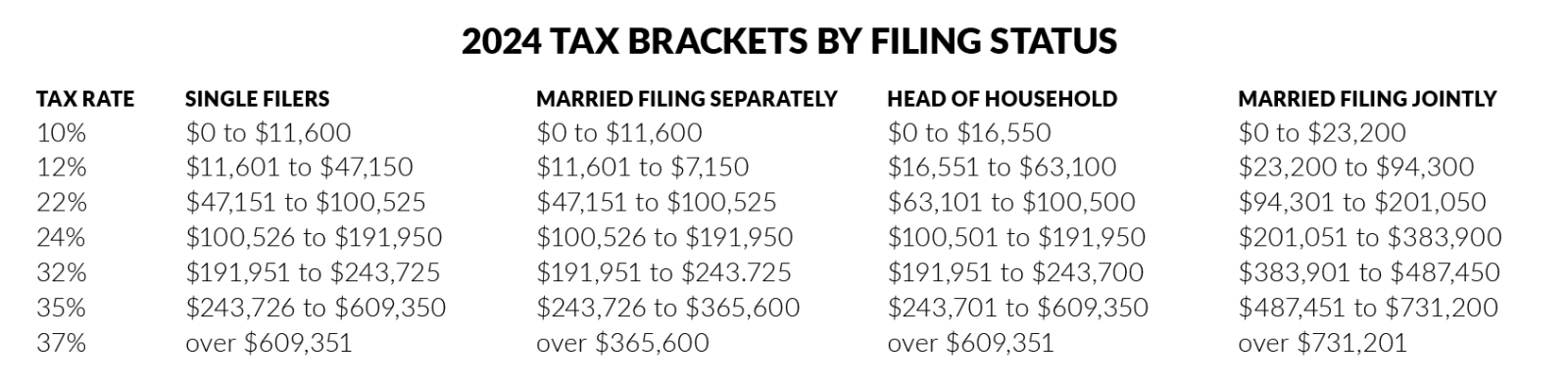

How the Progressive Tax System Works

In this system, each portion of your income is taxed at the corresponding rate, not your entire income. For example, if you are a single filer earning $120,000, your income would be taxed as follows:

The first $11,000 is taxed at 10%.

The amount from $11,001 to $44,725 is taxed at 12%.

The amount from $44,726 to $100,525 is taxed at 22%.

The portion from $100,526 to $120,000 is taxed at 24%.

This system ensures that only the income within each range is taxed at that rate, rather than your total income being taxed at the highest rate for which you qualify.

For further details and specific calculations, refer to IRS.gov for updates on federal income tax rates and brackets or speak with a local tax advisor.

Here’s a breakdown of the U.S. federal income tax brackets for 2024, which use a progressive tax system. This system means that different portions of your income are taxed at different rates. Here are the tax brackets and what they mean for each filing status.

This article provides general information about year-end tax strategies and is intended for informational purposes only. It does not constitute financial, tax, or legal advice. Tax laws can be complex and vary based on individual circumstances, and recent changes in tax regulations may impact these strategies. For personalized advice tailored to your specific situation, please consult a qualified tax professional or financial advisor. The information provided is accurate as of 2024, but we recommend consulting official IRS publicataions or a local tax expert for the latest updates. Sarah Berry, CPA, PLLC and Texarkana Magazine are not responsible for any actions taken based on the information in this article.